Are you tired of calculating the future values of your investments manually? Look no further than the FV function in Excel! It helps you conduct financial analysis and quickly determine the future values of different types of investments. And we will discuss it thoroughly in this article, along with an explanation of the function itself, calculation types, and a practical example.

For making informed financial decisions, getting accurate estimations is necessary. From financial modeling to simple personal investments, knowing the future value of your economic venture puts you at least a couple of steps ahead of others. The FV Function helps massively in this regard.

We intend to explore how this FV function works in Excel. We will also include a formula breakdown and explain the mechanism behind the function. Furthermore, the discussion on the types of calculation for the FV function and some useful scenarios for applications will help you understand it even better as you read through.

Let’s begin, then!

Contents

A Brief Look Into the FV Function

Excel’s FV Function belongs to the group of financial functions. The FV in the name stands for “Future Value”. Its job is to calculate the future value of an investment based on frequent but constant periodic payments over a specific period of time. There must be a constant interest rate as well for it to work. The future value calculation can also be done with a single lump sum investment.

The FV function has a counterpart in the PV function, which is also popular among financial experts. While the FV function returns the future value of an investment, the PV function gives you the “Present Value” of an investment. Do not mix these two functions because they serve contrasting purposes.

As an Excel user, you can initiate the FV function in four distinct ways.

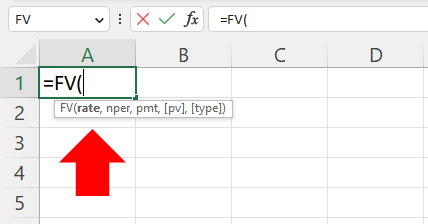

1. You can click on an empty cell and write the formula. It is the most popular of ways.

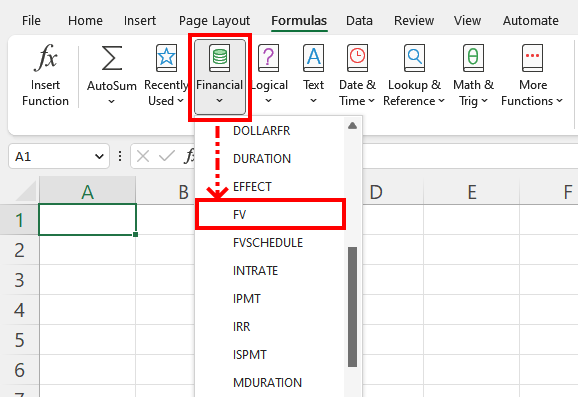

2. You can go to the Formulas ribbon, and then in the Function Library group, you can click on the Financial option. Then scroll down the functions list to find the FV function and click it.

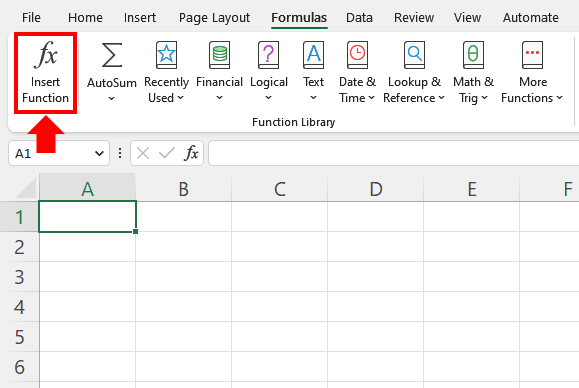

3. You can also click the Insert Function button inside the Function Library group.

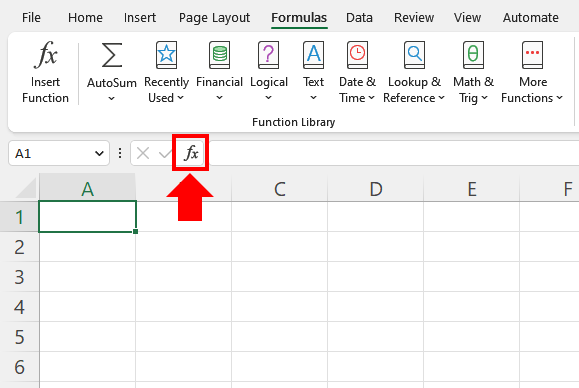

4. Alternatively, you can click the little Function (fx) button in the formula bar, as marked in the image below.

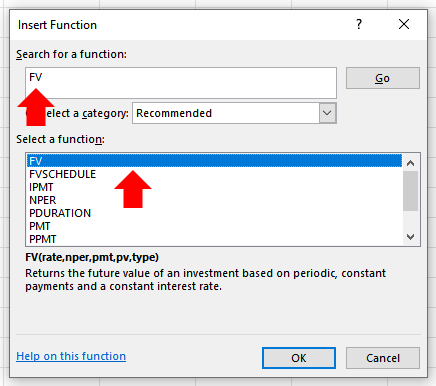

If you follow any method here apart from the first one where you write the formula manually, you will get an Insert Function window. Under the Search for a function box, write FV and press Enter. You will see the FV function in the list below. Click on it to select it, and then press OK.

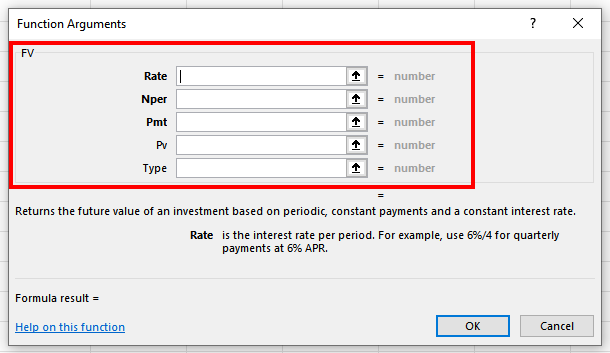

Consequently, you should get a Function Arguments window where you must input your arguments for the formula. We will talk about each argument thoroughly in this article’s next section.

We will also show a quick demonstration of it in this article’s Working Mechanism of the FV Function section. Keep on reading and explore the magic of the FV function!

FV Function in Excel: Syntax Breakdown

This section will look at the formula syntax for the FV function in Excel. We will break it down and explain each argument individually.

The FV function has five arguments, three of which are mandatory and the other two optional. The formula is FV(rate,nper,pmt,[pv],[type].

Here,

- FV : The function.

- rate : A mandatory argument. It is the interest rate for every period of the investment. By default, the value takes the annual period as default. If the period is semi-annual, the rate must be divided by 2. Similarly, if the period is monthly, the rate should be divided by 12.

- nper : The second mandatory argument. It refers to the total number of periods regarding the investment. Like the previous argument, nper, too, takes the annual period by default. If the period is semi-annual, this argument should be multiplied by 2. And for the monthly period, the value for this argument must be multiplied by 12.

- pmt : The third mandatory argument. It refers to the constant payment that will be made over the investment period. Depending on cash inflow or outflow, the value for this argument will be either positive or negative. And if the following argument in this formula, pv, is zero or not mentioned, this pmt argument must have a value present in the formula.

- pv : An optional argument. It refers to the present value. It can be a single lump sum or the amount present at the beginning of the investment. The function considers the default value zero if nothing is mentioned for this argument. In that case, the previous argument pmt must be mentioned in the formula.

- type : Another optional argument. It indicates the payment type in terms of the beginning or end of each period. It takes a boolean value of 0 or 1. If nothing is mentioned or 0 is included, the type of payment is considered to be the end of each period. Contrarily, if 1 is mentioned, the payment is made at the beginning of periods.

Through the syntax breakdown of the FV function, you now know what each argument means in the formula. In the next section, we will talk about how the function works in depth.

Working Mechanism of the FV Function

As you have seen, there are five arguments in the formula for the FV function. It follows a simple mode of action for calculating the result. The three mandatory arguments dictate the process. However, in special cases, the third and fourth arguments prove to be interdependent.

During the calculation, the FV function works in three steps.

1. The function looks for the present value (pv) and the periodic payment amount (pmt) in the formula.

2. Then it looks for the values in the number of periods (nper), the interest rate (rate), and the type of payment (type).

3. The FV function then takes the total amount (pv + pmt) for each period one at a time and multiplies the total value with the interest rate (rate) based on the type of payment (type). It continues multiplying the totals with the interest rate for the number of periods (nper) until the calculation is finished.

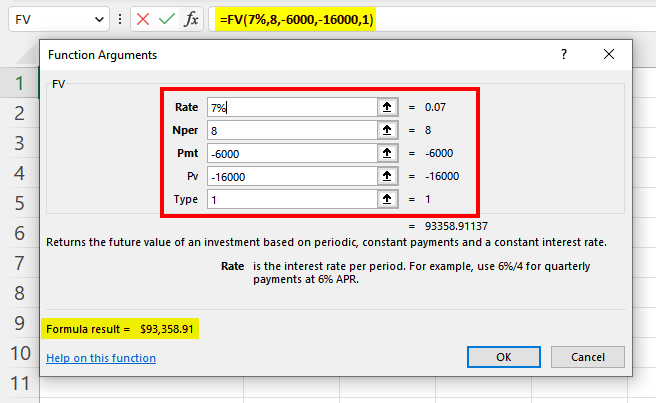

Let’s go through a quick demonstration of the FV calculation. Suppose we need to calculate a future value where $16000 is the amount at the beginning of the investment (pv). On an annual basis, there will be $6000 deposited (pmt) for 8 years (nper) at the beginning of the payment period (type). At the interest rate of 7% (rate), we need to calculate the final amount or future value of the investment we will be getting at the end of the period.

Now observe the image below. We put the respective values in those argument boxes. A preview of the result is visible in the bottom-left of the window. We will discuss the reason behind putting the pmt and pv in negatives here in the next section of the article.

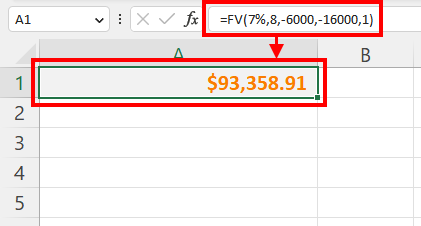

Now, after hitting Enter, we got the result as the future value of investing $6000 every year for 8 years at the interest of 7% with the initial deposit of $16000.

Pretty neat!

FV Function in Action: Two Calculation Types

Two arguments in the FV formula can have either positive or negative values during a calculation. It depends on the kind of cash flow you are working with. The two arguments in question are the Present Value (pv) argument and Periodic Payment (pmt) in the formula.

The output or the result of the calculation depends on the type of input here. Follow the explanation below for further understanding.

Type 1: Cash Inflow

The FV function in Excel is used for various purposes to calculate the future value of a particular investment. Among all possible uses, calculations with a cash inflow require the (pmt) and (pv) values to be in the positives.

Examples of cash inflows include incomings from stocks, bonds, dividends, etc. You invest an amount and get an inflow of cash from these sources. If you use the FV function to calculate the future value of your investment in such cases, you must use the values in positives for the (pmt) and (pv) arguments.

Type 2: Cash Outflow

Cash outflows work differently for the FV function in Excel. For the nature of the investment, the (pmt) and (pv) values need to be included in negatives for the calculations here.

Suppose you intend to make down payments or save an amount for a specific period of time where a fixed interest rate is applicable. You must deposit a specific amount in each period. You are depositing from your own earnings. Therefore, it is an outflow of cash from you. As a result, you must put a negative sign before the values of the (pmt) and (pv) arguments for an accurate calculation.

A Practical Example

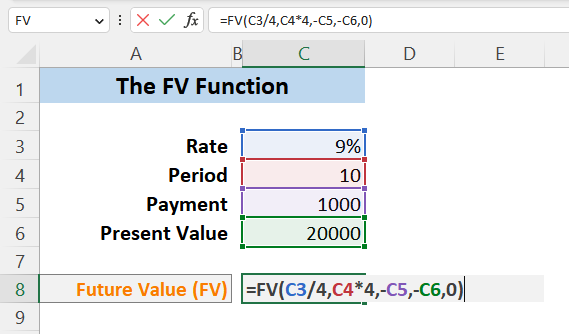

Now we will see a practical example of the FV function. Let’s work out the scenario first. Suppose you have $20000 at this moment that you would like to invest. For the next 10 years, you would further like to add $1000 in each quarter of the year during this period of time. The payment will be made at the end of each period. The annual interest rate is at 9%.

Since the FV function calculates on an annual basis, in this scenario, the interest rate must be divided by 4, and the number of periods must be multiplied by 4 for calculating on a quarterly basis. Now let’s see the calculation in the image below. By following this technique, we divided the interest rate by 4 and multiplied the period by 4. And both payment and present value are included in negatives because these amounts are working as cash outflows from you.

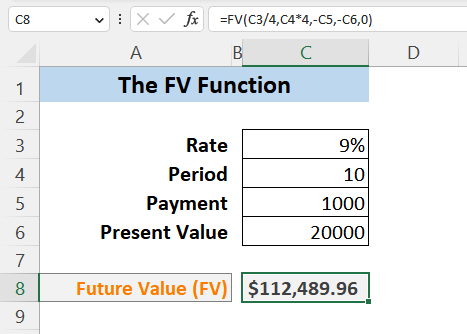

After inputting the formula as described, we get the calculated amount you will be getting after 10 years from the beginning of the investment period.

That’s it!

4 Important Use Cases for the FV Function in Excel

The FV Function is useful for a number of operations. In this section, we will discuss in brief the four most popular use cases of this financial function in Excel.

1. Loan Payments: The FV Function helps find out the total amount you will owe at the end of a period of your loan. It can calculate the future value with the interest and principal amount.

2. General Savings Planning: Suppose you want to save a specific amount of money for a particular goal. It could be for buying something or for a down payment. By using the FV function, you can calculate how much money you need to save in each period till you reach your goal.

3. Analyzing Probable Investments: The FV function in Excel can also assist you with analyzing and vetting future investments. For instance, if you have multiple investment options in your hands and need to find out the one that will give you the best possible return, you can easily find it by using this amazing financial function.

4. Retirement Savings Planning: Let’s say you are saving a particular amount of money every month into your retirement savings. You will retire after a certain period of time. With your current monthly deposit amount and the interest rate, you can calculate how much you will have saved at the time of your retirement by using the FV function.

Although there are more use cases for the FV function, the four we have discussed here are most frequently used by people.

Frequently Asked Questions (FAQs)

In this section, we will go through some most asked questions regarding the FV function in Excel. We will answer these questions to complete the article.

Q: Can I calculate the total interest paid on loan by using the FV function?

Ans. Yes, you can. After the calculation with the FV function, subtract the original loan amount from the result or your loan’s future value. The amount you will get afterward is the total interest you are paying on your loan.

Q: Can I use changing interest rates with the FV function to calculate the future value of an investment?

Ans. No. You must use a constant interest rate to calculate the future value of an investment with the FV function. Otherwise, the calculation will return incorrect results.

Q: Is it possible to use the FV function to calculate an investment’s future value with compound interest?

Ans. Yes, it is possible. But the interest rate must be constant and cannot vary over a period of time.

Q: Can I use the FV function to calculate the present value of an investment?

Ans. No. For calculating the present value of an investment, you must use the PV function.

Q: How can I convert an annual interest rate to a monthly interest rate for the FV function?

Ans. You need to divide the annual interest rate by 12 to convert it to a monthly interest rate.

Q: Can I use the FV function to calculate the future value of an investment with variable payments?

Ans. No. The payment must be constant for the FV function to work. Variable payments will result in inaccurate calculations.

Concluding Thoughts

The FV Function in Excel is a financial function that everyone can work with. From deciding where to invest based on the possible outcome to calculating the future value of your savings, the FV function covers the whole ground effortlessly.

We talked about the FV function in this article point by point. We did a syntax breakdown and explained how the function works. Then we discussed two calculation types and a practical example of the FV function. In the latter part of the article, we explained the function’s four most popular use cases. We ended it with a section on some frequently asked questions with their answers.

The FV function is easy and useful. However, we strongly suggest you be mindful when inputting the values. The function calculates on an annual basis. Therefore, if your calculation involves something different, be careful and check the values twice beforehand. Last but not least, be sure to practice working with this function a few times for ultimate mastery.